Table of Content

Heavenly Sent Home Care has committed to providing seniors with the assistance they require to keep their freedom and integrity of life. Our services let elders to age safely in the warmth of their own house – in the place where they want to be. We believe that every elder should be worthy of remaining smiling, wholesome, and at home. Research the service offerings and pricing of the home care agencies in the zip code and find out about physical therapy and hospital readmission today. Care.com does not employ, recommend or endorse any care provider or care seeker nor is it responsible for the conduct of any care provider or care seeker. Care.com provides information and tools to help care seekers and care providers connect and make informed decisions.

YP advertisers receive higher placement in the default ordering of search results and may appear in sponsored listings on the top, side, or bottom of the search results page. We strongly encourage you to verify the license, qualifications, and credentials of any care providers on your own. The Care.com Safety Center has many resources and tools to assist you in verifying and evaluating potential care providers.

Is this your business?

Compare the pricing and locations of the home health aide companies in the zip code and find out about caregiving teams and probate attorneys today. This site is for educational purposes only and is not in place to offer official medical diagnosis or advice. Always consult with a licensed healthcare professional for any medical information, diagnosis or treatment.For more information, please read our Terms and Conditions.

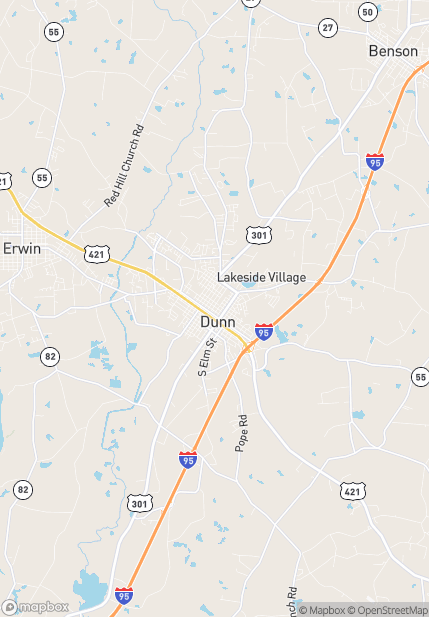

We follow ANSI guidelines for pruning, and we provide our employees with a safe and secure environment to work in for our employees. We are a big supporter of non-profits such as Trees For Dunn and their cause too. Heavenly Home Healthcare LLC is a locally-owned and operated professional tree care business.

Heavenly Home Health Care, LLC

This website is not represented by a health care provider and the information provided herein is for general knowledge purposes only. Do not use the information on this website to diagnose or treat any medical condition. We also offer continuing training to our team of climbers as well as our certified arborists. Our arborists attend numerous workshops throughout the year to stay current with all trends throughout the tree service industry? We are constantly updated on diseases in and around the Dunn, NC, as well as treatment for these diseases or conditions.

These hospice home care providers make the patient emotionally stronger to cure their illness. And for that besides the doctors advise they also suggest some therapies and medicines cure themselves. They prescribe medication and therapies to get rid of pain, shortness of breath, and also other symptoms that reduce the illness and prevent them from these serious injuries.

More Care Options

The taxonomy code for Heavenly Home Health Care Llc's main specialty, In Home Supportive Care, is 253Z00000X. An In Home Supportive Care Agency provides services in the patient? Hospice home care is a service that considered for a sick patient who has not much time in their life. These patients don’t have much time more than 6 months in their lives. At this time fulfilling their every desire and comfort is mainly called the hospice care service.

We ensure our clients’ prosperity, fulfilling harmony of mind to the families, and introduce dignity of goal in our organizations every day. Physical assistance or physical supervision refers to the use of non-coercive physical interaction. It is to facilitate everyday activities or for medicinal reasons for the health and care of a disabled person. We provide modern choices in quality elder caregivers, advanced technology clarifications, and excellent client service. We have detailed info about Heavenly Home Healthcare LLC in Dunn, NC and other HARNETT County, NC home health providers. Heavenly Home Health Care, LLC is an in home supportive care agency located in Dunn, NC.

An In Home Supportive Care Agency provides services in the patient's home with the goal of enabling the patient to remain at home. We are regarded as one of the best tree care companies in Dunn, NC. Tree trimming, removal, cabling and tree sales/planting are all provided. We also offer stump grinding and diagnosis, treatment diagnosis, and treatment. Our tree services have become an established name in arboriculture to commercial and residential customers alike. We also have arborists who have worked on Dunn trees for more than 20 years, and we're excited to pass on our knowledge to our clients.

Care.com does not provide medical advice, diagnosis or treatment or engage in any conduct that requires a professional license. ‡ Descriptions, provider messages, and reviews are user submitted. While we make our best effort to verify the accuracy of information submissions, DocBios cannot guarantee that the information is accurate and/or up to date. DocBios is not an advice or referral service and does not guarantee, approve, or endorse any particular healthcare provider. This website is not represented by an attorney or elder care provider and is intended for general knowledge purposes only. By clicking 'Request Information' you agree to this website's Privacy Policy and Terms and Conditions.

Once your doctor refers you for home health services, the home health agency will schedule an appointment and come to your home to talk to you about your needs and ask you some questions about your health. The home health agency staff will also talk to your doctor about your care and keep your doctor updated about your progress. It’s important that home health staff see you as often as the doctor ordered.

This service can be given at the patient’s own house and also at the service center. At this time most of the patients want to stay with their families. But sometimes for a variety of reasons, it becomes impossible for the patients to stay with their families. At that time they have to take service from the service canter by staying there.

Details and information displayed here were provided by this business and may not reflect its current status. We strongly encourage you to perform your own research when selecting a care provider. Home health care helps you get better, regain your independence, and become as self-sufficient as possible. Research the reviews of the Home Healthcare Services in HARNETT County, NC, along with their phone numbers on our nursing agencies database. Our goal is to be the promising supporter of choice for households looking for personalized, dignified supervision for ageing cherished ones.